No, Zebit isn’t going out of business. While some concerns and changes within the company have raised questions, Zebit remains operational and continues to provide its buy-now-pay-later (BNPL) services to consumers who have limited access to traditional credit. In this article, we’ll explore the reasons behind recent speculations, clarify rumors about Zebit’s financial stability, and shed light on its current status.

Contents

Is Zebit Going Out of Business?

Speculation about Zebit potentially closing its doors began circulating due to market adjustments and restructuring efforts made by the company in recent years. After delisting from the Australian Securities Exchange (ASX) in 2022, primarily due to operating losses and high bad debt charges, concerns about Zebit’s future grew. However, despite these challenges, Zebit has adapted to changing economic conditions and continues to offer its services to U.S. customers.

Is Zebit Experiencing Financial Challenges?

Like many BNPL companies, Zebit has faced obstacles stemming from shifts in the economy and evolving consumer habits. While exact financial details aren’t publicly accessible, reports suggest the company has undergone restructuring to navigate these difficulties. Despite this, Zebit continues to operate and serve its customer base, with no official indications of a complete shutdown.

Have Zebit’s Services or Partnerships Been Disrupted?

Zebit has made adjustments to its services and partnerships in response to market conditions. These changes have affected certain aspects of its offerings, such as product availability and supplier relationships. Such shifts are not unusual and may be part of Zebit’s efforts to maintain operational sustainability while continuing to support its customers with BNPL options.

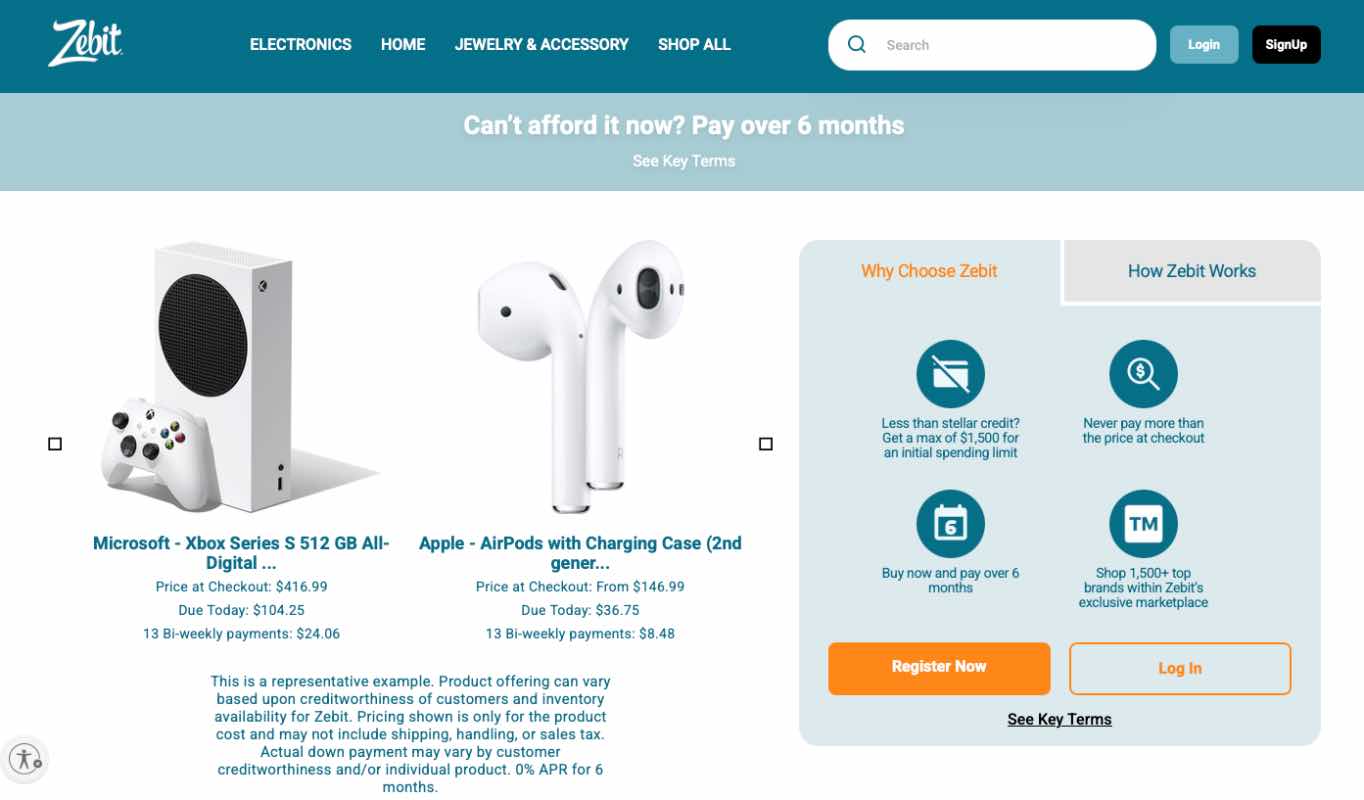

An Overview of Zebit

Founded in 2015, Zebit is a BNPL platform that offers consumers interest-free credit to purchase products like electronics, home goods, and apparel. Zebit’s mission is to provide financial flexibility and transparency for those who might struggle with traditional credit. By offering fixed repayment terms with no hidden fees, the platform has positioned itself as a solution for underserved customers seeking accessible financing options.

Who Are the Owners of Zebit?

Zebit was previously listed on the ASX, where it operated as an independent BNPL provider. Its management team is focused on maintaining the platform’s mission of providing fair and accessible credit options to U.S. consumers. Although no longer publicly traded, Zebit continues to function under its core leadership and business model.

How Do Recent Developments Impact Zebit Customers?

For Zebit customers, recent changes may have influenced the availability of certain products or altered some credit terms. While these adjustments may affect individual experiences, the platform remains accessible, and Zebit continues to prioritize affordable, transparent payment solutions for its users.

Final Reflections

Although Zebit has faced challenges and undergone changes in recent years, the company is not going out of business. Zebit continues to adapt its services to meet customer needs in a shifting financial environment, staying true to its mission of providing interest-free credit options. For now, Zebit remains a reliable option for those seeking flexible, transparent financing solutions.